idaho inheritance tax rate

The top estate tax rate is 16 percent exemption threshold. In Kentucky for instance the inheritance tax applies to all in-state property even for out-of-state inheritors.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Key findings A federal estate tax ranging from 18 to 40.

. Inheritances that fall below these exemption amounts arent subject to the tax. You must complete Form CG to compute your Idaho capital gains deduction. Tax Rate.

Idaho also does not have an inheritance tax. Plus 3125 of the amount over. Idaho has no inheritance tax or gift tax.

And if your estate is large enough it may be subject to the federal estate tax. Keep in mind that if you inherit property from another state that state may have an estate tax that applies. That means that if your husband or wife passes away and leaves you a condo you wont have to pay an inheritance tax at all even if the property is located in one of the states.

Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. Impose estate taxes and six impose inheritance taxes. No estate tax or inheritance tax.

1 2005 contact us in the Boise area at 208 334-7660 or toll free at. Idahos capital gains deduction. Plus 1125 of the amount over.

Idaho state tax rates Idaho state income tax rate. 9117 amended December 23 2003. Select Popular Legal Forms Packages of Any Category.

The top estate tax rate is 16 percent exemption threshold. For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income. If you receive a large inheritance and decide to give part of it to your children the 15000 limit per year still applies.

For more information contact. Idaho doesnt have an estate tax although it did at one time. Idaho state sales tax rate.

Idaho has no state inheritance or estate tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Estates and Taxes.

Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property. Overall inheritance tax rates vary based on the beneficiarys relationship to the deceased person. Idaho Inheritance and Gift Tax.

Idaho Probate Court Finder Magistrate division Court wwwiscidahogov. Idaho does not levy an inheritance tax or an estate tax. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

All Major Categories Covered. That means your total taxable estate is 440000 as its worth that much more than the 1206 million threshold. Idaho State Commission 800.

As of 2018 an individual can give another person up to 15000 per year as a gift tax-free. Inheritance laws from other states may apply to you though if a person who lived in a state with an inheritance tax leaves something to you. Pennsylvania had decoupled its pick.

Twelve states and Washington DC. Any more than that in a year and you might have to pay a certain percentage of taxes on the gift. Map showing state inheritance tax rates.

Plus 4625 of the amount over. Use this link to find the Magistrate division Court in Adams County or any Idaho county. Plus 6625 of the amount over.

Keep reading for all the most recent estate and inheritance tax rates by state. Plus 3625 of the amount over. At the appropriate tax tier youll pay the base rate of 70800 plus an additional 64600 190000 taxed at 34.

No estate tax or inheritance tax. Idaho state property tax rate. Capital Gains Tax Rate Calculator.

For this to be reinstated either the Idaho Legislature or Congress would have to change the law. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Maryland is the only state to impose both. Spouses are automatically exempt from inheritance taxes. Probate is handed by the Magistrate division Court in Idaho.

However like all other states it has its own inheritance laws including the ones that cover what. That comes out to a. For more information see what are Idahos sales tax rate and our Use Tax brochure.

Tax is tied to the federal state death tax credit to the extent that the available federal state death tax credit exceeds the state inheritance tax. For more details on Idaho estate tax requirements for deaths before Jan. You will also likely have to file some taxes on behalf of the deceased.

Plus 5625 of the amount over. No estate tax or inheritance tax. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

Idaho Estate Tax Everything You Need To Know Smartasset

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Estate Tax Everything You Need To Know Smartasset

4 Things You Need To Know About Inheritance And Estate Taxes

How To Avoid Estate Taxes With A Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

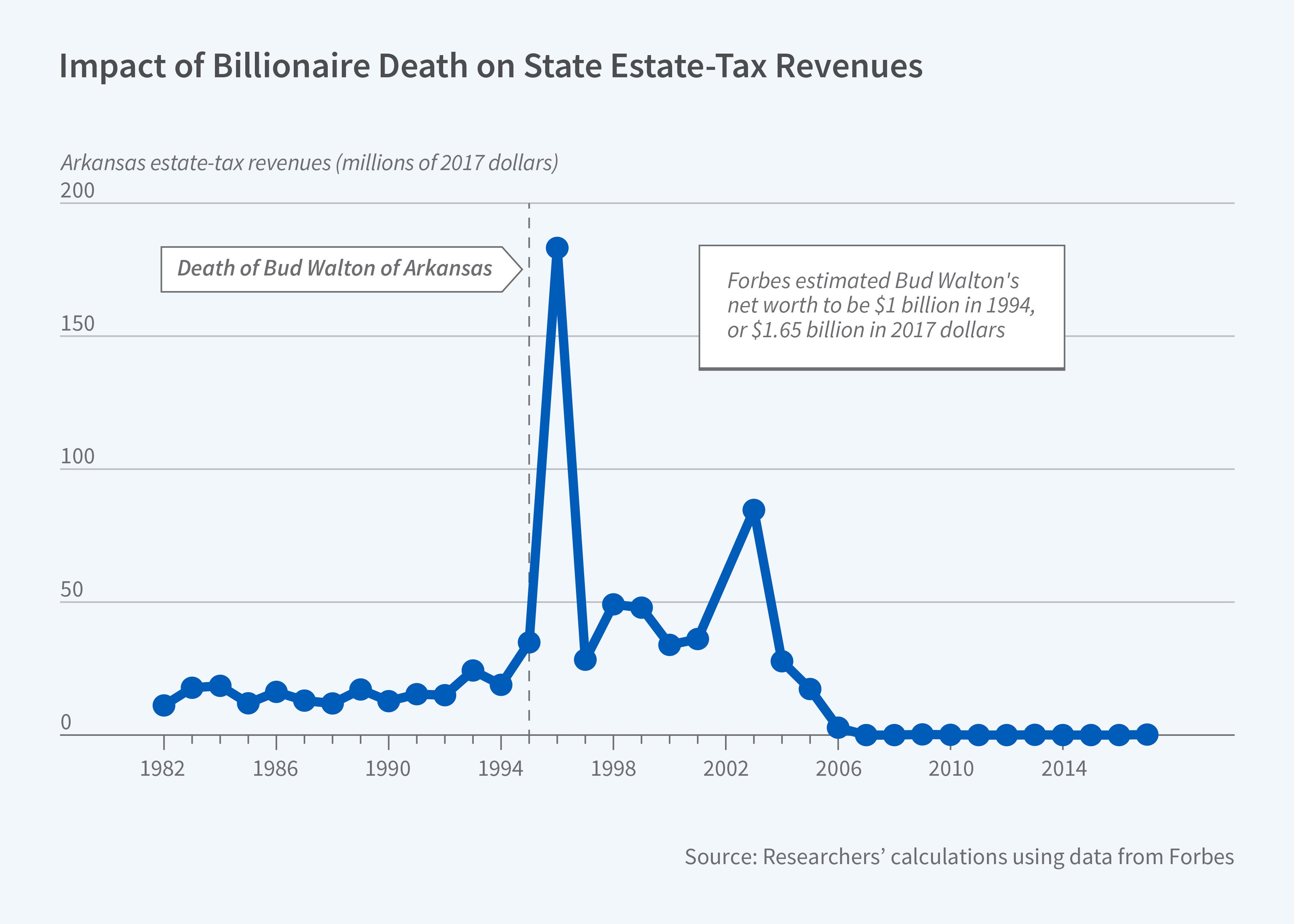

State Level Estate Taxes Spur Some Billionaires To Move Nber

States With An Inheritance Tax Recently Updated For 2020

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Proposed Inheritance Tax Changes Would Be Devastating For Family Farms Study Shows Spudman

State Estate And Inheritance Taxes Itep

How Is Tax Liability Calculated Common Tax Questions Answered

How To Avoid Estate Taxes With A Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With An Inheritance Tax Recently Updated For 2020

Recent Changes To Estate Tax Law What S New For 2019

Picking An Estate Planning Lawyer In Boise Is Sufficiently Simple When You Know Precisely What You Are Sea Estate Planning Estate Planning Attorney How To Plan

Land Patent And Blm How To And Ownership Rights Of Inheritance And Search Youtube Land Patent Stop Trustee Sale Foreclosure Foreclosures Free Webinar Real